charitable gift annuity example

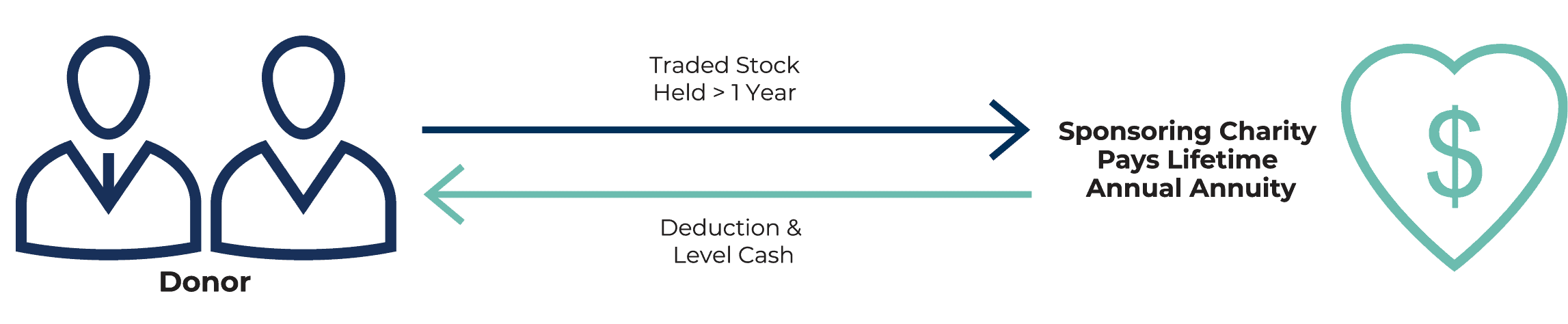

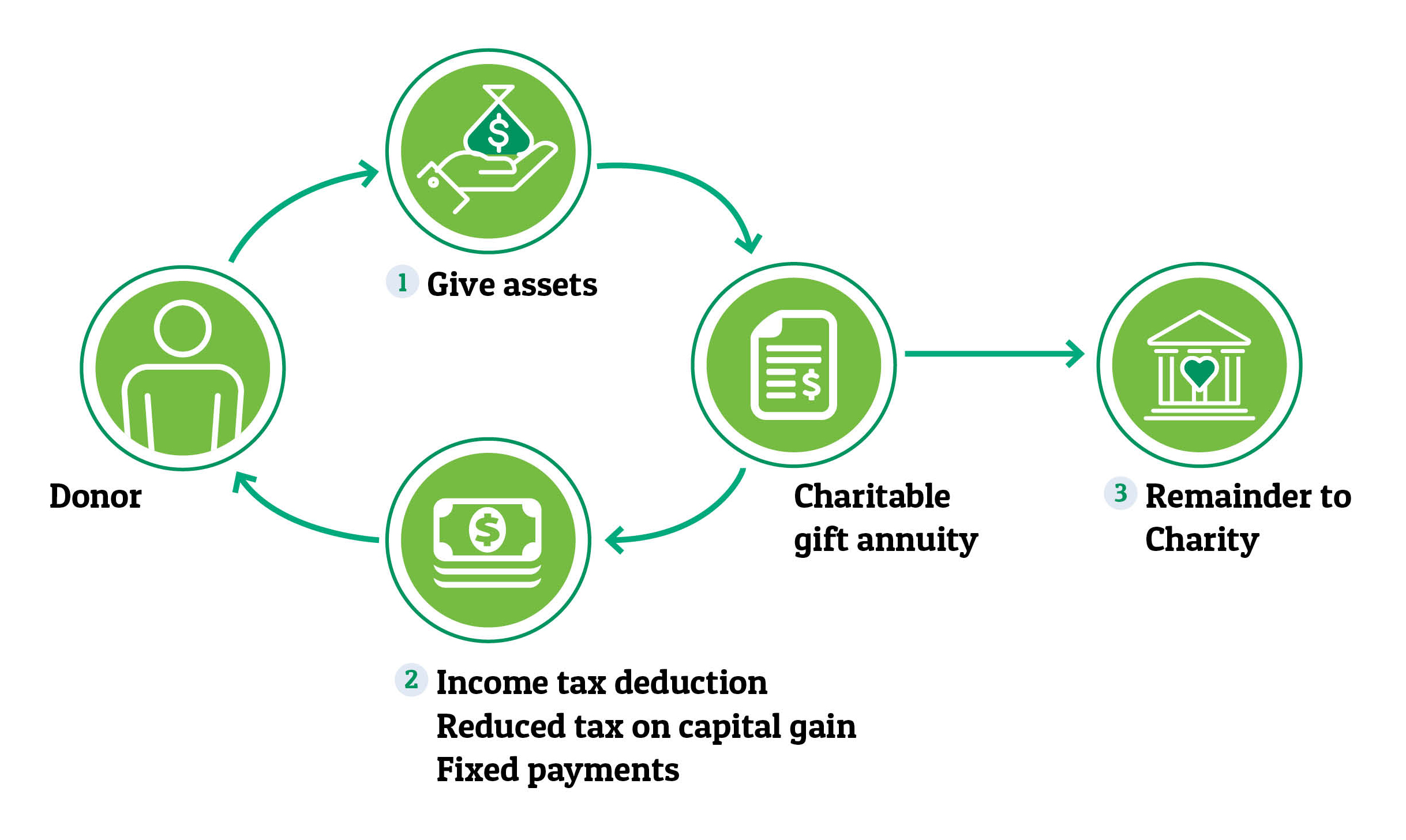

Ad Bank of America Private Bank Is Committed to Help You Meet Your Philanthropic Mission. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity.

Charitable Gift Annuity Tax Deductions Cga Rates Ren

For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year.

. This type of trust is a financial arrangement that allows a trustee to hold assets for one or more. This agreement is a qualified charitable gift annuity under the Code of Virginia section 382-1061. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. You will incur no costs to establish the arrangement and no. Charitable Gift Annuities An Example.

An Example of How It Works. Ad Our Powerful Multi-Channel Outreach Capabilities Connect You to More Donors in Less Time. Dennis 75 and Mary 73 want to make a contribution to Easterseals but they also want to ensure that they have dependable income during their retirement years.

Dennis 75 and Mary 73 want to make a contribution to Miami Jewish Health but they also want to ensure that they have dependable income during their. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12027 the amount of the 25000 donation. Ad Bank of America Private Bank Is Committed to Help You Meet Your Philanthropic Mission.

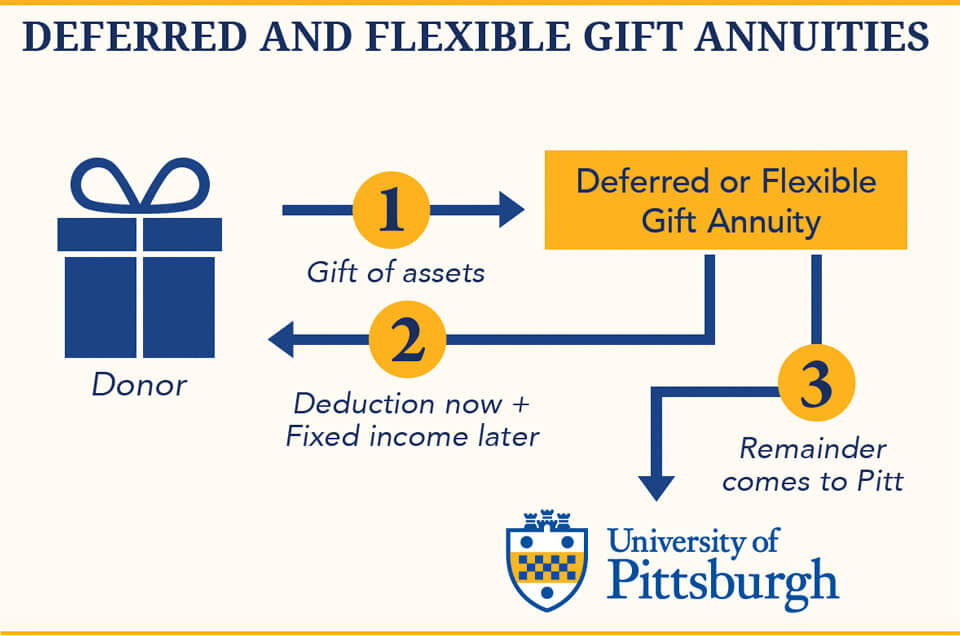

The following is a sample disclosure for a charity to consider using based upon advice and guidance from its own legal counsel. Also part of their 100000 is a charitable gift and therefore the Richards. This version of the charitable gift annuity is designed for younger donors and those who want to plan now for future financial needs for example.

A charitable gift annuity example. The payment rate for joint gift annuities. In addition to these fixed annuity payments you receive a charitable tax-deduction in the year you make.

Ad Search For the Results that are Great for You. Ad Get this must-read guide if you are considering investing in annuities. Charitable Gift Annuity.

After Anns death the balance of the invested funds will go to her favorite qualifying charities including a local animal shelter. A charitable remainder annuity trust CRAT is an option for estate planning. The minimum contribution to form a CGA is 25000 for individuals 60 years or older.

Charitable Gift Annuities An Example. They donate 50000 in cash to Hadassah to establish a two-life charitable gift annuity. Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years.

It shall be construed to comply with all Internal Revenue laws and. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. Dennis 75 and Mary 73 want to make a contribution to Wayland but they also want to ensure that they have dependable income during their retirement years.

As with any other. Search For the Latest Results at Bestdiscoveriesco. We understand that you may be interested in a.

Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. Based on their ages they will receive a payout rate of 59 percent 2950 each year for life and are also. Charitable Gift Annuity Deferred.

An Example of How It Works. A charitable gift annuity is a simple arrangement between you and Pomona College that requires a one or two page agreement. Based on current calculations 380600 of the 5500 annual income will be free from income tax for 164 years.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Charitable Gift Annuities An Example. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

In exchange the charity assumes a legal obligation. An Example of How It Works.

Consumer Report Gift Annuity Calculator

Charitable Gift Annuities Development Alumni Relations

Charitable Gift Annuities Giving To Stanford

Estate Planning Checklist Estate Planning Checklist Funeral Planning Checklist Funeral Planning

Charitable Gift Annuity Focus On The Family

Life Income Plans University Of Maine Foundation

Charitable Gift Annuity Wise Healthy Aging

Charitable Gift Annuities Barnabas Foundation

Found On Bing From Ovdf Org Brochure Examples How To Plan Brochure

Charitable Gift Annuities Uses Selling Regulations

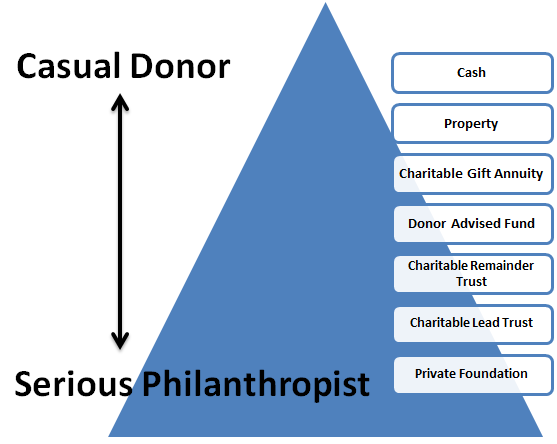

4 Long Term Ways To Give To Charity Capstone Financial Advisors

Tools Techniques 101 The Charitable Gift Annuity Withum

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuities National Wildlife Federation

Http Www Valamohaniyercharitabletrust Com Annadan Html Free Food Providing Functions Are Every Month Amavasai Trust Words Charitable Charity Organizations

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center

Charitable Gift Annuity Deferred University Of Virginia School Of Law